How venture capital broke America

Technologist and author Catherine Bracy on what went wrong in Silicon Valley and how to rebuild after the broligarchs burn it all down

How did Silicon Valley — once the destination for innovators and investors looking to change the world — give rise to the tech oligarchs who seem happy enough to rule over ashes?

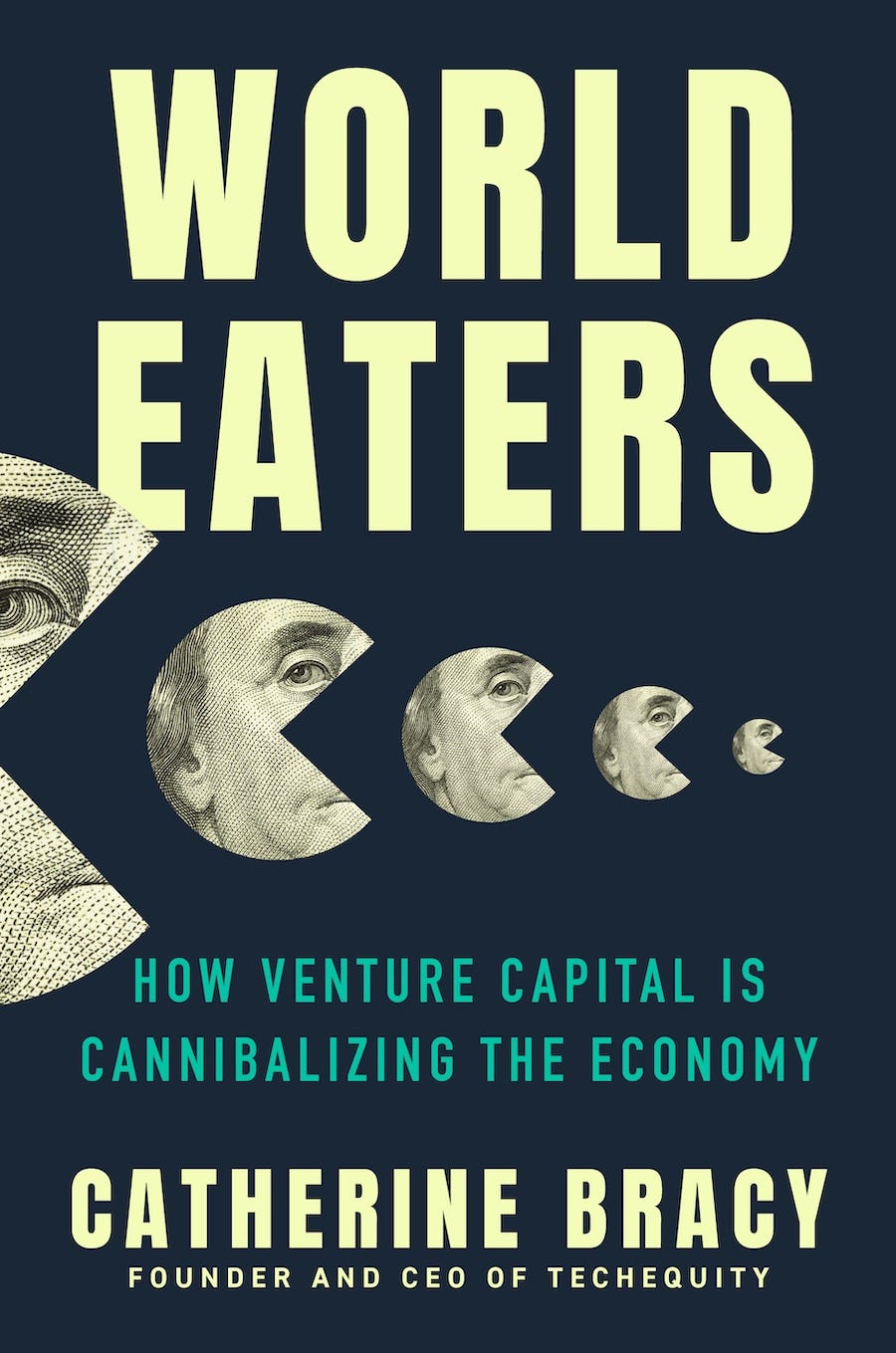

That’s the question Catherine Bracy, the technologist, organizer, and veteran of Code for America and Obama for America’s Technology Field Office in San Francisco, sets out to answer in her new book, World Eaters: How Venture Capital is Cannibalizing the Economy.

For Bracy, the answer doesn’t have much to do with technology itself, which is still full of possibility (her current organization, TechEquity, is focused on reanimating the original promise of extending tech’s benefits to all). The problem is in how technology is funded, and how a subset of venture capital firms obsessed with the “power law” (most of the returns come from a tiny percentage of firms, while most firms contribute only a tiny percentage of returns) turned the funding of startups into a cutthroat, high-stakes battle for supremacy that condemned most new companies to failure while building a few firms — and their founders — into behemoths with the money and power to dismantle American institutions and reshape the economy and the country in their image.

We talked to Bracy about how Silicon Valley lost its way, the perverse incentives that led the Sand Hill Road venture firms and the billionaires they built down the path from creative destruction to an embrace of sheer destruction, and how investing could be reformed to fund the broad range of innovations that could actually change the world — for the better next time.

A lot of people looking to diagnose what’s wrong with America look to Silicon Valley. They tend to point to the weird stuff: Curtis Yarvin, or Peter Thiel's interest in not ever dying. But you talk about how the real problem is how venture capital organizes investment, which has made the big tech companies as big as they are and has enabled them to so fully dominate everything.

Those of us who advocate for quote-unquote progressive tech, responsible tech, ethical tech policy have focused so much on the technology layer as the place where we should be regulating. But I came to understand, long story short, that it wasn't the technology that was the problem. It was actually the business models and the economic incentive structures that are wrapped around the technology that are the problem, that are creating monopolies, that are creating all these harms in our lives.

The dominant dogma of Silicon Valley is something called the power law. And the power law is this idea that when you're investing in risky startups, the way to make money is to spread your money across a few dozen companies with an understanding that most of them will fail, but a few of them will be hugely successful.

Silicon Valley venture capital incentive growth by giving every startup a very, very big target. They make sure there's a lot of money on the line for each one, right?

The idea is that if you are making these risky bets, most of them will fail, but a small number will have huge upside and more than make up for the failures.

The early venture capitalists proved that you could do this well. And then a bunch of Wall Street, institutional money came in and incentivized people not to pursue breakthrough technologies, but just to pursue that return profile. They were agnostic about what kind of companies they were actually investing in.

That mindset shift, away from focusing on breakthrough technologies and letting the chips fall where they may on the return and towards the return they're driving for, is where all the harm comes from.

This corresponds with the shift from hardware to software as the driver of tech. In the smartphone and apps era, most of the things that are marketed as technological breakthroughs are financial breakthroughs more than anything else.